The BlackRock USD Institutional Digital Liquidity Fund (BUIDL), tokenized in collaboration with Securitize and initially launched on Ethereum, is expanding to the Aptos, Arbitrum, Avalanche, Optimism and Polygon networks.

Each blockchain addition opens up their respective applications to natively interact with BUIDL, increasing access for investors, DAOs and other digital asset-native firms by allowing developers to build on the fund in their preferred ecosystem, Securitize said in a Wednesday statement. The tokenized fund offers an onchain yield, dividend accrual and near real-time peer-to-peer transfers.

"We wanted to develop an ecosystem that was thoughtfully designed to be digital and take advantage of the advantages of tokenization," Securitize CEO and co-founder Carlos Domingo said. "Real-world asset tokenization is scaling, and we're excited to have these blockchains added to increase the potential of the BUIDL ecosystem. With these new chains we'll start to see more investors looking to leverage the underlying technology to increase efficiencies on all the things that until now have been hard to do."

BNY will continue to act as the fund administrator and custodian for BUIDL on Ethereum, as well as these additional blockchains.

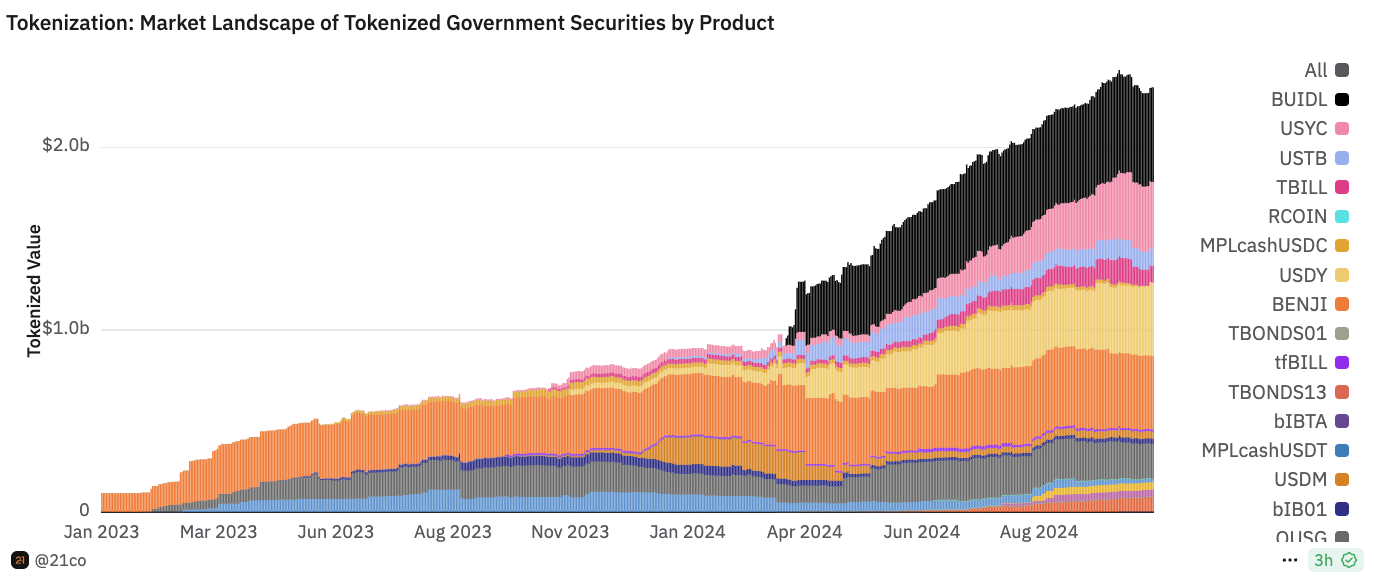

The growing market for tokenized government securities

Franklin Templeton’s OnChain U.S. Government Money Fund (FOBXX), represented by the BENJI token, was the first U.S.-registered fund to use a public blockchain to process transactions and record share ownership, introduced in 2021. It currently operates on Aptos, Arbitrum, Avalanche, Stellar and Polygon.

However, BlackRock’s BUIDL swiftly began to dominate the tokenized government securities niche, rising to become the largest fund in less than 40 days following its March launch. BUIDL has since grown to account for $517 million in assets under management, equivalent to around 22% market share in the $2.3 billion market, according to data compiled by asset management firm 21.co, the parent company of bitcoin exchange-traded fund provider 21Shares.

Tokenized government securities market by product. Image: 21.co/Dune Analytics.

The BENJI product remains the second-largest, with $403 million in assets under management, per 21.co.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.